Table of Content

The phone banking executives would answer all your questions regarding your HDFC home loan. Applying for loans and credit cards through MyMoneyMantra is 100% safe & secure. Our systems ensure complete data security and privacy for each applicant. I declare that the information I have provided is accurate & complete to the best of my knowledge. I hereby authorize HDFC Ltd. and its affiliates to call, email, send a text through the Short messaging Service and/or Whatsapp me in relation to any of their products.

Also team is supportive and responsive. Housing Development Finance Corporation Limited (“HDFC”) & HDFC Sales is not an Investment Advisor and does not provide any investment or financial planning advice. National Pension System is administered and regulated by Pension Fund Regulatory and Development Authority created by an Act of Parliament. The information provided on our website is for informational purposes only and it should not be considered as financial advice.

FAQs on HDFC Bank Home Loan Customer Care

With trust of 70 lakh customers, we assure hassle free access to the best Home Loans up to 10 crore for housing loan borrowers in India. We use latest technology and AI to serve customers across the length & breadth of our diverse country. We curate the best available offers from banks, NBFCs & financial institutions according to your profile, credit score, cash needs & repayment capacity. Sometimes it is possible that you may need to address your specific queries or concerns to the Nodal Officer or the Zonal officer of your branch. Here’s a detailed city-wise list made available to you for the same.

Make sure you receive this number in case the bank misses it, and save this information until your problem has been resolved. Your Customer Number is your unique identification number provided by HDFC Bank for all of their customers holding a Savings/ Current Account with the bank. It is vital to save your unique ID number for future referrals in case of assistance or any similar requirement with the bank. If you don’t get a satisfactory response from any the above-mentioned channels within a turnaround time of 30 working days of registering a complaint then you may approach the Banking Ombudsmen. When you press 3 your call will be directed to the loan department and you can directly talk to a loan expert about your home loan queries.

HDFC Bank Kolkata branches with IFSC Codes and Customer Care Number

Till now, I am highly satisfied with the services provided by HDFC. Definitely I will recommend HDFC for home loan requirement. In this challenging situation, the entire process was carried out in a smooth way. Even the query raised was sorted out in a very short time with no hurdle. Every person involved in the inquiry procedures were courteous. As regards deposit taking activity of HDFC Ltd. (hereinafter referred to as "the Company"), the viewers may refer to the advertisement in the newspaper/information furnished in the application form for soliciting public deposits.

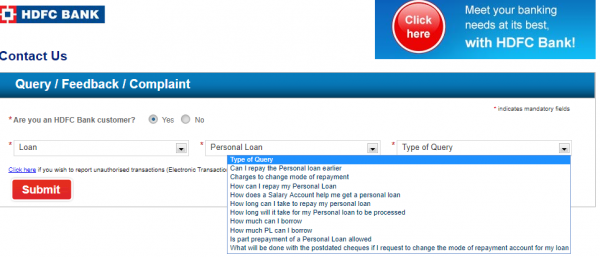

On selecting your preferred concern, you’ll then be connected to the expert on the subject and get immediate assistance on your problem. To fasten up the process, make sure you have all your Home Loan related documents in place and available at the time of the call. The expert on call usually cross-checks your information to understand your case in detail before proceeding ahead with the call.

hdfc’s customer awareness month

The consent herein shall override any registration for DNC/NDNC. At HDFC, we truly believe in providing best in class services to our customers. All our products and policies are built around the core attributes of customer friendliness and convenience. However, if you are not satisfied with the services provided, please click here to post your grievance. Magicbricks is a full stack service provider for all real estate needs, with 15+ services including home loans, pay rent, packers and movers, legal assistance, property valuation, and expert advice. As the largest platform for buyers and sellers of property to connect in a transparent manner, Magicbricks has an active base of over 15 lakh property listings.

The process of applying for a personal loan is simple and quick. You need to fill the loan application form and submit it along with the documents checklist at your nearest bank branch or online. You can contact HDFC credit card customer care in Kolkata for any doubt or query. All you need to do is get your phone and call on the 24x7 HDFC credit card customer helpline number. You can call on the below mentioned number on all days including public and bank holidays.

You can send it to the Manager, HDFC Bank Cards division. Does HDFC Bank have a different contact number for NRI customers? Yes, HDFC Bank has different customer care for NRI customers. There are different numbers for NRI customers staying in the United States, Canada, Singapore, and Kenya. Various Builder/Developer who have advertised their products.

Check more information on HDFC Ltd Home Loans. Borrowers can compare the best home loan offers in Kolkata here, which helps in understand which bank is offer home loans @ lowest rates with lowest processing fees and fastest disbursal time. The contribution can be made by you upon opening an account with HDFC.

If you have not received a satisfactory response for your grievance from our Chief Grievance Redressal Officer within 7 working days, please click here to escalate it to our Managing Director. If you have not received a satisfactory response for your grievance within 7 working days,please click here to escalate it to our Chief Grievance Redressal Officer. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

For details on bank account, credit card, loan or any other services dial 1. Check what are the interest rates and processing fees of HDFC Ltd Home loans in Kolkata. You can compare HDFC Ltd. with other home loans banks in Kolkata to get better offers on housing loans. Dial 1 - for details on the bank account, credit card, loan or any other services.

The norms of eligibility for a personal loan offered by HDFC bank have been given below. An applicant has to ensure that he/she is able to meet the given criteria. A personal loan EMI calculator is the tool that helps you calculate Equated Monthly Installments. Here is an example showing the payments you will have to do if you take a personal loan from HDFC Bank worth ₹7,00,000 for the tenure of 5 years and an interest rate of 12% p.a.